MSP Key Performance Indicators: Past Due Invoices

As an MSP, we work so hard to deliver a quality service to our clients and nothing would irritate me more than past due invoices. Cash is the lifeblood of any business and having aging receivables can put a serious crunch on cash flow. This metric is simple; easy to pull from most systems and highly recommended reviewing it weekly. But this is one metric that it’s more important what you do AFTER you review than just staring at the metric each week.

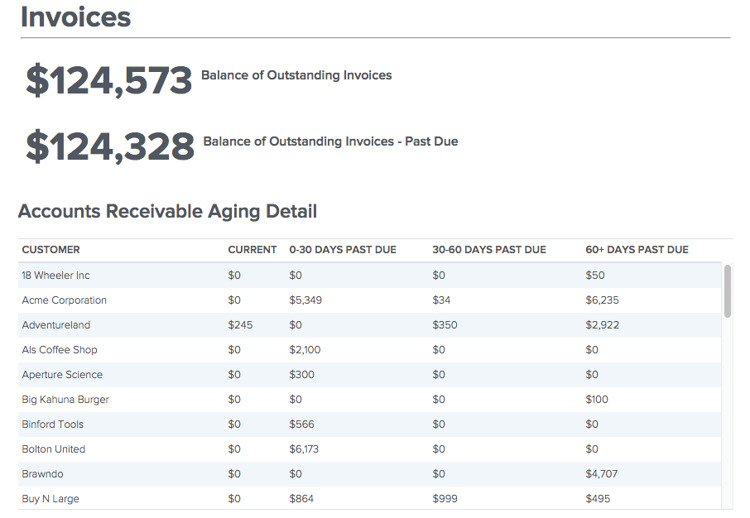

a sample BrightGauge report for tracking Accounts Receivable Aging Detail

A few obvious ways to address this proactively was collecting in advance or ACH but in the event those won’t work for you, here are a few things we did to monitor and address Past Due Invoices:

Credit Applications – We had a policy that any new clients would have to fill out a credit application form ahead of time for us to check their credit worthiness. But in reality we rarely did that. Sales people were so excited about closing a deal that the credit process would get skipped. And let’s be honest, as a manager when someone had a signed contract but no credit application you tend to look the other way and approve the contract. Who wouldn’t?

Accounting Team Follow Up – We had 1 individual that was dedicated to following up on all of our receivables on a regular basis. I realize not everyone can have a dedicated person, in that case make it a priority to whomever does the “Accounting Function” within your team. Someone should be responsible for the status of all the invoices and making sure they have been received by the client and are in the approval process. If anything is off the normal process it should be brought to Management’s attention.

Tie Commission To Collections – This was a brilliant move my father did very early on at Compuquip. If any receivable was paid after 90 days you lost your commission as a sales rep. (To clarify, I didn’t like the rule as a sales rep but loved it as a manager). It naturally turned the sales folks into mini-credit officers. Not that we wanted them focusing on credit but we wanted them to at least consider it given that their compensation was ultimately tied to it.

Set A Process To Review Regularly – In every sales meeting we always had an agenda item for “AR Past Dues” which we reviewed all invoices over 60 days based on a report someone in Accounting would prepare for us. Each sales rep received a complete report of all their client outstanding invoices and they had to come prepared with an explanation on how they planned to resolve the issue.

Like any area of your business, it’s a matter of setting a process to measure the metric to help drive action within your organization and eventually improve the metric.

This blog is part of our Internal Metrics That Matter For MSPs blog series; you can download the white paper here.

Free MSA Template

Whether you’re planning your first managed services agreement, or you’re ready to overhaul your existing version, we've got you covered!