Grow your business with actionable data insights from BrightGauge

Unify your organization's most critical data

Holistically view your business data within a single solution.

Let your data do the talking

Check out the key features

Dashboards

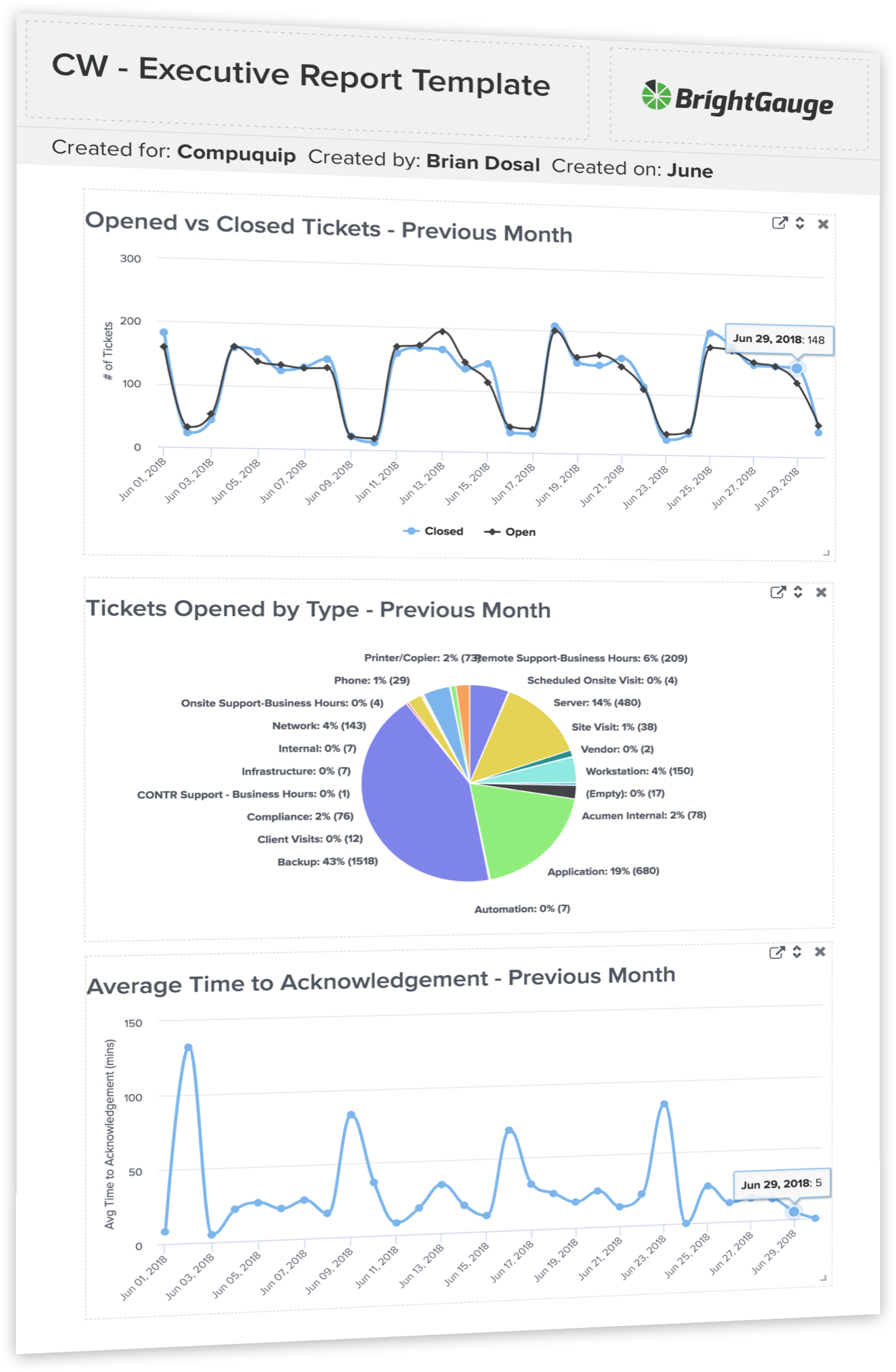

Reporting

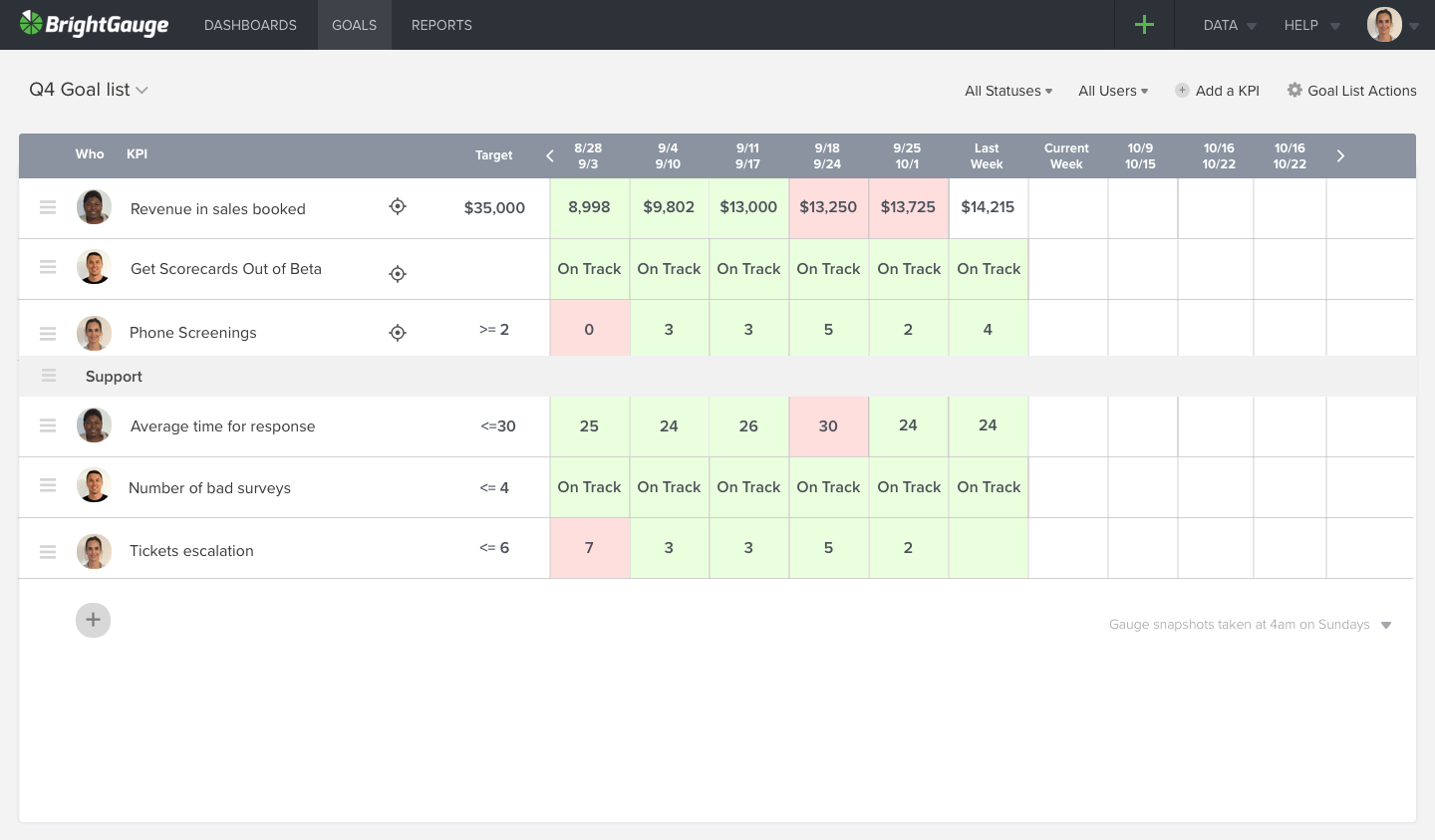

Goal Setting

Explore BrightGauge Features

Equip customers and colleagues alike with the right data from within BrightGauge

Calculated Metrics

Dig deeper into your data by adding, subtracting, multiplying, and dividing one metric against another. BrightGauge automatically computes these formulas for you.

Datasource Mashup

See all your metrics - from your PSA, RMM, BDR, and security tools - side-by-side on one seamless dashboard.

Snapshots

Identify patterns and trends more accurately with Snapshots - gauges that automatically capture a data point for you and plot it onto a chart you can easily analyze.

Embedded Gauges

Want to show your prospects how quick you are to respond to tickets? Show off your data with embeddable gauges on public sites.